Awareness of climate change in company boardrooms is changing and there is a growing focus on climate risk, which is enhancing the flow of information. Pension schemes now have access to more reliable data on ESG and climate risks and are slowly expanding their information requirements to biodiversity risk. More pension schemes are establishing net zero targets. These are all signs of strong evolutionary change. However, are we doing enough?

To begin with, it’s really encouraging to see that the availability and reliability of data on ESG and climate risks has improved over the last five years. This partly reflects a greater focus by companies on corporate social responsibility, which has driven more reporting on environmental, social and governance factors. It also reflects more demand for ESG data from asset owners and asset managers, driven by regulation and client expectations.

To begin with, it’s really encouraging to see that the availability and reliability of data on ESG and climate risks has improved over the last five years. This partly reflects a greater focus by companies on corporate social responsibility, which has driven more reporting on environmental, social and governance factors. It also reflects more demand for ESG data from asset owners and asset managers, driven by regulation and client expectations.

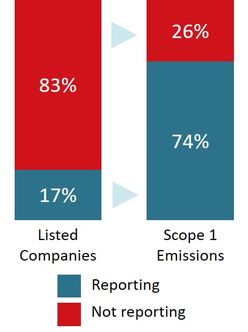

When it comes to climate data, a slightly different picture emerges. According to our sustainability data partner, Clarity AI, only about 17% of publicly listed companies report their direct emissions – around 6,500 companies globally. On the face of it, this appears low but the devil is in the detail. In summary, these 6,500 companies emit about 74% of scope 1 emissions of the full universe of public companies worldwide, which number between 40-45,000. It means we have a good percentage of the data that actually matters, although as an industry, we are still a bit more challenged in getting our hands on scope 3 emissions data.

Reporting companies account for three quarters of Scope 1 emissions

Source: Clarity AI: Out of 40-45,000 listed companies, ~17% report their CO2 Scope 1 emissions. Despite representing a small fraction, those ~6,500 companies account for 74% of Scope 1 emissions of the full universe of listed companies

Getting your hands on good data is just the starting point. Interpreting the data and using is correctly is just as critical and this is where education is key. For example, when looking at carbon emissions, intensity-based targets don’t guarantee absolute emissions reductions. If a company’s emissions intensity decreases but its production volume increases at a larger rate, its absolute emissions may still increase. That’s why absolute emissions-based targets are more transparent. We need to apply our own thinking and logic when reviewing data. Sometimes, it’s looking at the data and asking these questions: Is it consistent with industry standards? Is it aligned with the emissions of similar companies? And is it plausible for a company of a given size and growth pattern?

Furthermore, what’s still confusing for many is the variability of data between the different sustainability reporting providers – there is no single version of the truth. The latter is what we hope we’ll move to over the next five years, which is more than just an evolutionary change, coupled with more alignment in regulations between pension schemes and asset managers on sustainability reporting.

Taking action on net zero

The biggest opportunity for the industry is to demonstrate the path to net zero alignment. Many pension schemes have outlined their ambition to achieve net-zero by 2040 or 2050. This requires three important steps. First, we need more evidence-based reporting, preferably yearly, and the necessary criteria, to articulate how net-zero goals are being achieved. Criteria may include ‘net zero aligned’ and ‘net zero aligning’, ‘emissions performance year on year’, ‘full disclosure of material emissions’ and whether or not investee companies have fully developed low-carbon plans.

Moving to net zero also requires a strong level of collaboration between pension schemes and asset managers. Pension schemes have very specific goals when it comes to areas like climate risk and net-zero commitments and this translates into their stewardship and engagement policies. If pension schemes hold mutual funds, there needs to be more alignment with asset managers on stewardship and engagement. This also means pension schemes taking a more active role by asking their asset managers how companies they are investing into, either directly or through a mutual fund, are prepared for the transition to net zero, and reviewing if these plans are integrated into each company’s business strategy.

Finally, net zero plans need to be incorporated into regular communication to pension scheme members. It fosters transparency and trust, which are important virtues when it comes to reporting on sustainability-led objectives.

Where next?

What’s increasingly clear is that the topic of sustainability is growing and evolving quickly. Only recently, the World Economic Forum cited biodiversity loss and ecosystem collapse as the fourth largest global risk behind climate-related risks over the next ten years. Managing biodiversity risk will become another factor that pension schemes have to think about and frameworks, such as The Task Force on Nature Related Financial Disclosures, along with additional data requirements around nature, will need to be considered.