©xartproduction

©xartproductionWhat is an ETF?

An ETF (Exchange Traded Fund), is similar to a mutual fund in that its open ended, holds assets (predominately stocks or bonds) and aims to provide positive returns on investments. In Europe most ETFs are within the UCITS structure and regulated by the local regulatory body, such as the Central Bank of Ireland (CBI) or the Commission de Surveillance du Secteur Financier (CSSF). ETFs main difference to mutual funds, is that they trade on exchange like an equity, this provides advantages in terms of intra-day liquidity.

Most ETFs track an index, commonly known as a tracker. But recently active ETFs are becoming more popular and witnessing significant growth.

What are the key market trends?

When thinking about ETFs, there are two important themes which are central to this product, evolution and growth.

Ongoing evolution has been an important factor in the growth of ETF products. The first ETFs housed a single share class, just passive (equity) products Today’s ETF products have evolved far beyond passive into active and smart beta strategies*, holding virtually all asset classes, including multi-currency, multi-shareclass; hedged, unhedged, accumulating and distributing. Some recent discussions have centred around ETFs holding alternative and real assets or tokenised versions of these, which may be the next step in their evolution.

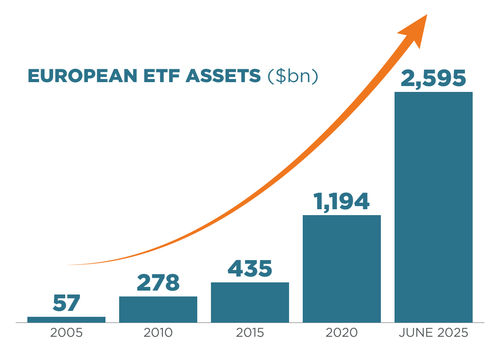

It took a long time for the European market to pick up on ETFs and by end 2010, assets had reached just $313bn. By 2019, ETF assets hit $1tn and since then have experienced double-digit compound annual growth. The latest figures for 2025 inflows show little sign of this growth slowing, with many market commentators bullish as to ETFs’ continued growth.

If you look at ETF growth on a longer term basis, ETFs assets are doubling every 5 years.

This pattern is leading key parties within the ETF industry to predict that this pace of growth will continue, JP Morgan forecasts that European ETF assets will reach $6tn by the end of 2030, while EY’s predict $4.5tn.

(*) Strategy aimed at outperforming market capitalisation-weighted indices by selecting and weighting securities according to specific criteria

Why ETFs are popular for Asset Managers and Investors

There are a considerable number of tailwinds which are fuelling ETF growth such as, increasing use by retail investors, interest from younger investors and more interest in self directed investment. Many Asset Managers are choosing to enter the ETF market to open a new distribution channel, and sell product to a new group of investors.

For investors, it’s the core attributes of an ETF which are the key selling points, namely

- Accessibility – ETFs can be traded digitally making them highly accessible to all investor types

- Liquidity – ETFs can be traded on an intra-day basis, thus providing a high level of liquidity

- Transparency – ETFs publish fund holdings on a daily basis

- Low cost – ETFs are generally traded at a lower pricing point that mutual funds

CACEIS ETF offering by the numbers

How we support your ETF business?

- An experienced team based in Ireland, the center of excellence for ETFs

- ETF order management and settlement

- Multiple settlement models supported ICSD, ICSD+ and local CSDs

- Primary market order entry portal, developed in-house to provide bespoke functionality to support ETFs

- Advanced ETF order capabilities with real time monitoring

- Dedicated ETF fund accounting team

- Follow the sun model: early NAV delivery before market opening

- Production through a partnership with Ultumus

Why choose CACEIS?

PARTNERSHIP

Accompany clients through the whole launch process

EXPERIENCE

Top 5 player in ETF servicing since 2016

EXPERTISE

Dedicated team and centres of excellence servicing ETFs

INNOVATION

On going evolution of offers and tools

ONE STOP SHOP

A single provider covering the entire chain with a modular offering

PRICING

Competitive pricing offer