SCANNING JULY-AUGUST 2017

SCANNING JULY-AUGUST 2017

European Regulatory Watch Newsletter

Summary

EUROPE

AIFMD - ESMA Q&As update

![]()

Background

The Alternative Investment Fund Managers Directive ("AIFMD") puts in place a comprehensive framework for the regulation of alternative investment fund managers within Europe.

ESMA is required to play an active role in building a common supervisory culture by promoting common supervisory approaches and practices. It does this by providing responses to questions raised by the general public and competent authorities in relation to the practical application of the AIFMD.

The last Q&As update on application of the AIFMD was made on 24 May 2017 (available here)

What's new?

On 11 July 2017, ESMA published an updated Q&As on the application of the AIFMD, including three new questions and answers (ESMA34-32-352 – the "Updated Q&As on AIFMD"), clarifying the following:

- In a situation where an AIF purchases a loan in the secondary market the value of the loan to report should be the valuation of the loan, as it is taken into account in the calculation of its NAV.

- The total value of assets under management of a fund expressed in a base currency other than the euro should be converted in euros using the spot currency rate at the date of the reporting period.

- AIFMs should report the NAV in the base currency of the AIF.

The Updated Q&As on AIFMD is available here.

What's next?

This Updated Q&As on AIFMD is intended to be continually edited and updated as and when new questions are received.

Alternative performance measures - ESMA Q&As update

![]()

Background

An alternative performance measure is a financial measure of historical or future financial performance, financial position, or cash flows, other than a financial measure defined or specified in the applicable financial reporting framework.

On 5 October 2015, the ESMA issued guidelines which apply to alternative performance measures disclosed by issuers or persons responsible for drawing up a prospectus.

The purpose of this Questions/Answers document ("Q&A") is to promote common supervisory approaches and practices in the implementation of these guidelines.

What's new ?

On 12 July 2017, the ESMA updated its Q&A on the implementation of its Guidelines on the Alternative Performance Measures ("APMs") for listed issuers (ESMA32-51-370 – the "Updated Q&As").

The Updated Q&As entails four new questions/answers which cover the following issues:

- The definition of APMs in the context of interim financial statements;

- The prominence of APMs, i.e. the way they are presented compared to IFRS figures outside financial statements;

- The use of the "compliance by reference" principle as set out in the guidelines; and

- The appreciation of "result of operating activities" as an APM.

The Updated Q&As is available here.

What's next?

The Q&As on APM is intended to be continually edited and updated as and when new questions are received.

Benchmarks - ESMA Q&As on BMR

![]()

Background

The purpose of this questions and answers ("Q&As") document is to promote common, uniform and consistent supervisory approaches and practices in the day-to-day application of the Benchmarks Regulation ((EU) 2016/1011, "BMR").

It does this by providing responses to questions asked by the public, financial market participants, competent authorities and other stakeholders. The Q&As tool is a practical convergence tool used to promote common supervisory approaches and practices.

What's new?

On 5 July 2017, ESMA published its Q&As document on the BMR (ESMA70-145-11 – the "Q&As on BMR").

The Q&As on BMR contains two questions and answers:

- EU index providers already providing benchmarks before 30 June 2016 are allowed to continue their activity of provision of benchmarks in full and supervised entities in the Union are able to use all the benchmarks provided by such EU index providers, including new benchmarks created after 1 January 2018. This transitional period lasts until 1 January 2020, or until and unless the authorization or registration of the EU index provider is refused.

- EU index providers starting providing benchmarks after 30 June 2016 are allowed to continue this activity after 1 January 2018, and supervised entities in the Union are able to use this benchmarks on and after 1 January 2018 (even if the authorisation or registration is not yet granted) and until 1 January 2020 or until and unless the authorisation or registration of the EU index provider is refused. However, in the case that an EU index provider starts to provide benchmarks after 30 June 2016 and provides a new benchmark after 1 January 2018, supervised entities will not be allowed to use such newly provided benchmark, unless the EU index provider obtains first authorisation or registration.

The Q&As on BMR is available here.

What's next?

The Q&As on BMR is intended to be continually edited and updated as and when new questions are received.

Benchmarks - Commission publishes new Implementing Regulation broadening the list of critical benchmarks used in financial markets

![]()

Background

The Regulation (EU) 2016/1011 of the EU Parliament and of the EU Council (the "BMR") entered into force on 30 June 2016.

It provides that under certain circumstances a competent authority can require supervised entities to contribute to a critical benchmark. The selection of the supervised entities shall be made on the basis of the size of a supervised entity’s actual and potential participation in the market that the benchmark intends to measure.

It also requests ESMA to develop a number of draft regulatory and implementing technical standards to be submitted to the EU Commission by 1 April 2017.

On 12 August 2016, the EU Commission published Implementing Regulation (EU) 2016/1368 in the OJEU (the "Implementing Regulation", available here), establishing in its Annex, a list of critical benchmarks used in financial markets pursuant to the BMR. It was applicable as from the next day.

What's new?

On 29 June 2017, the EU Commission published Implementing Regulation (EU) 2017/1147 in the OJEU (the "Updated Implementing Regulation"). The Updated Implementing Regulation includes in its annex a broader list of critical benchmarks used in financial markets.

The Updated Implementing Regulation is available here.

What's next?

BMR will be fully applicable as of 1 January 2018.

MAR - ESMA Q&As update

![]()

Background

The Market Abuse Regulation (EU) 596/2014 came into effect on 3 July 2016 ("MAR", available here). It aims at increasing market integrity and investor protection, enhancing the attractiveness of securities markets for capital raising.

The ESMA is required to play an active role in building a common supervisory culture by promoting common supervisory approaches and practices. It does this by providing responses to questions raised by the general public and competent authorities in relation to the practical application of MAR.

What's new?

On 6 July 2017, the ESMA published an updated version of its questions and answers document on MAR (70-145-11 – the "Updated Q&As on MAR"). The ESMA has added one question/answer relating to Managers’ transactions and the definition of Closely associated persons under MAR.

In this context, the ESMA confirms that the reference to "the managerial responsibilities of which are discharged" in Article 3(1)(26)(d) of MAR should be read to cover those cases where a PDMR within an issuer (or a closely associated natural person) takes part in or influences the decisions of another legal person, trust or partnership to carry out transactions in financial instruments of the issuer.

The Updated Q&As on MAR is available here.

What's next?

The Q&As on MAR is intended to be continually edited and updated as and when new questions are received.

MAR - ITS published in the OJEU

![]()

Background

Regulation (EU) N0 596/2014 on Market Abuse ("MAR") came into effect on 3 July 2016. It aims at increasing market integrity and investor protection, enhancing the attractiveness of securities markets for capital raising.

Article 33 of MAR provides that competent authorities ("CAs") shall provide ESMA annually with anonymised aggregated data regarding all criminal investigations undertaken, administrative sanctions and other administrative measures imposed by the CA.

What's new?

On 30 June 2017, the Commission Implementing Regulation (EU) 2017/1158 was published in the OJEU (the "CIR").

The CIR addressed to CAs covers the following:

- Contact points – In order to facilitate the communication between CA and ESMA and avoid unnecessary delays or failed submission, each CA should designate a contact point specifically for the purpose of submitting the information required;

- The forms, timeline for annual submission of aggregated data;

- The reporting procedures and forms;

- The invalidation of existing reports.

The CIR is available here.

What's next?

The CIR entered into force on 20 July 2017 and is directly applicable in all member states. ESMA shall publish data on criminal sanctions imposed in its annual report.

MiFID II - ESMA consults on suitability requirements

![]()

Background

The MiFID II Directive 2014/65/EU (available here) encompasses the rules on governance, products, investor protection and information disclosure.

MiFID II and MiFIR ((EU) 600/2014, available here), together with the Commission delegated acts as well as regulatory and implementing technical standards ("ITS"/"RTS"), will be applicable from 3 January 2018.

The assessment of suitability is one of the most important requirements for investor protection in the MiFID II framework. It applies to the provision of any type of investment advice (whether independent or not) and portfolio management. In accordance with the obligations set out in MiFID II and the Commission Delegated Regulation 2017/565, investment firms providing investment advice or portfolio management have to provide suitable personal recommendations to their clients or have to make suitable investment decisions on behalf of their clients.

This paper sets out for consultation the draft ESMA guidelines on certain aspects of the MiFID II suitability requirements.

What's new?

On 13 July 2017, the ESMA issued a public consultation on certain aspects of the suitability requirements under MiFID II (ESMA35-43-748 – the "Consultation Paper").

The Consultation Paper includes proposals on the draft guidelines in order to:

- Consider recent technological developments of the advisory market, including the increasing use of robo-advice, i.e. automated or semi-automated systems for the provision of investment advice or portfolio management;

- Give relevance to the results of supervisory activities conducted by national competent authorities on the suitability requirements;

- Incorporate some insights of studies in the area of behavioral finance; and

- Provide additional details on some aspects that were already covered under the ESMA’s 2012 guidelines.

The Consultation Paper is available here.

What's next?

The consultation closes on 13 October 2017.

The ESMA expects to publish a final report in Q1/Q2 2018.

MiFID II - ESMA IT projects

![]()

Background

In a letter addressed to the EU Commission on 2 October 2015, the ESMA highlighted the difficulties that regulators, at EU and national level, and market participants were facing in developing the necessary IT infrastructure and having it in place by the original MiFID II (2014/65/EU, available here) / MiFIR ((EU) 600/2014, available here) application start date of January 2017.

The subsequent approval of a one-year delay for the implementation of MiFID II/MiFIR has provided the ESMA, national competent authorities and market participants with additional time in which to develop the necessary systems.

What's new?

On 28 June 2017, the ESMA sent a letter to the EU Parliament, Commission and Council updating them on the implementation of ESMA’s IT projects regarding MiFID II (ESMA70-156-158, the "Letter").

The ESMA will deliver a specific IT infrastructure for the implementation of MiFID II on 3 January 2018. This will include pan-European IT systems, which will allow:

- The reception and publication of reference data;

- The computation and publication of various liquidity assessments and thresholds to be used for the new transparency and tick size regimes;

- The implementation of the double volume cap mechanism;

- The coordination of suspensions from trading; an

- The exchange of transaction reports.

The Letter also provides a timeline for the implementation of the different elements of its MiFID II IT infrastructure.

The Letter is available here.

MiFID II - ESMA Q&As update on investor protection

![]()

Background

The MiFID II Directive 2014/65/EU (available here) encompasses the rules on governance, products, investor protection and information disclosure.

MiFID II and MiFIR ((EU) 600/2014, available here), together with the Commission delegated acts as well as regulatory and implementing technical standards ("ITS" / "RTS"), will be applicable from 3 January 2018.

The purpose of a questions and answers document ("Q&A") is to promote common supervisory approaches and practices in the application of MiFID II on investor protection issues.

What's new?

On 10 July 2017, the ESMA updated its Q&As on the implementation of investor protection topics under the MiFID II (ESMA35-43-349 – the "Updated Q&As on Investor Protection").

The ESMA has included 2 new Q&As relating to recording of telephone conversations and electronic communications, and best execution.

Best execution

MiFIR states that securities financing transactions ("SFTs") are not subject to the pre and post trade transparency obligations. While no specific exemption was included with respect to the RTS 27 best execution reporting obligations, Recital 10 of RTS 27 refers to the need for regulatory consistency between its requirements and those on post trade transparency. In this context, ESMA considers that the best execution reporting requirements set out in RTS 27 should not apply to SFTs.

The ESMA wishes to make clear that, irrespective of the above clarification concerning the application of RTS 27 to SFTs, the MiFID II best execution requirements otherwise apply to investment firms when carrying out SFTs.

The ESMA also wishes to clarify that while RTS 27 would not apply to SFTs, this would not lead to a complete absence of execution quality reports for SFTs, as RTS 28 explicitly requires investment firms to report, inter alia, on order routing behaviors specifically with respect to SFTs and to provide a summary on the quality of execution obtained.

Recording of telephone conversations and electronic communications

Internal telephone conversations and electronic communications that "are intended to result in transactions" or "relate to" the reception and transmission of orders, execution of orders on behalf of clients and dealing on own account are subject to the MiFID II recording requirement.

ESMA expects firms to record all internal telephone calls or electronic communications regarding the handling of orders and transactions. However, ESMA would not ordinarily expect persons carrying on back-office functions to be captured by the requirements.

To clarify, the records of any internal face-to-face conversations that relate to the reception and transmission of orders, execution of orders on behalf of clients and dealing on own account will be caught by the general record-keeping requirements under MiFID II.

The Updated Q&As on Investor Protection is available here.

What's next?

ESMA will periodically review the Q&As and update it where required.

MiFID II - ESMA updates its guidelines on transaction reporting, order record keeping and clock synchronization

![]()

Background

MiFIR defines obligations for Investment firms, Trading Venues, ARMs and Systematic Internalisers as regards the reporting, order record keeping and clock synchronisation.

The ESMA has issued guidelines in December 2015 to ensure a supervisory convergence in the implementation of the RTS defined on these subjects. The purpose of these Guidelines is to promote common supervisory approaches and practices in the implementation of the above-mentioned RTS.

What's new?

On 8 August 2017, ESMA updated its Q&A document on transaction reporting, order record keeping and clock synchronization (ESMA/2016/1452 – "the Update").

The Update corrects some factual mistakes and typos, as well as some inconsistencies in the technical part of the guidelines. ESMA emphasizes that none of the corrections aims to alter the substance or policy provisions of the Guidelines as originally published.

The Update is available here.

What's next?

The Guidelines are currently undergoing translation in the official languages of the European Union and will enter into application on 1 January 2018.

MiFID II/MiFIR - ESMA Q&As update

![]()

Background

The MiFID II Directive (2014/65/EU, available here) encompasses the rules on governance, products, investor protection and information disclosure.

MiFID II and MiFIR, together with the Commission delegated acts as well as regulatory and implementing technical standards, will be applicable from 3 January 2018.

The purpose of the questions and answers documents ("Q&As") is to promote common supervisory approaches and practices in the application of MiFID II and MiFIR.

What's new?

On 7 July 2017, the ESMA updated its Q&As regarding the implementation of MiFID II and MiFIR.

- Q&As on MiFID II/MiFIR commodity derivatives topics (11 new questions, ESMA70-872942901-28 – the "Q&As on Commodity Derivatives")

The ESMA provides clarification on several provisions on position limits and position reporting, especially dealing with the notions of "end client". As far as asset managers are concerned, ESMA defines that position reportings are to be provided at the funds level, except when the parent undertaking of the fund influences the decision as regards such positions. ESMA also stresses that a firm that would not report position for a client due to non EU laws regarding data protection and bank secrecy would not be deemed compliant with its obligation under MiFID II.

The Q&As on Commodity Derivatives is available here. - Q&As on MiFID II/MiFIR market structures topics (14 new questions, ESMA70-872942901-38 – the "Q&As on Market Structures")

The ESMA provides clarification on:

- The direct electronic access and algorithmic trading (9 questions);

- Multilateral and bilateral systems (3 questions); and

- Access to central counterparties (2 questions).

The Q&As on Market Structures is available here.

- Q&As on MiFIR data reporting (5 new questions, ESMA70-1861941480-56 – the "Q&As on Data Reporting")

The ESMA updated clarification on total issued nominal amount, quantity, reference data for financial instrument, transaction reporting and order record keeping.

The Q&As on Data Reporting is available here.

What's next?

The ESMA will periodically review these Q&As and update them where required.

MiFID II/MiFIR - 3 new ITS published in the OJEU

![]()

Background

The Directive 2014/65/EU as amended by the Directive (EU) 2016/1034 ("MiFID II", respectively available here and here) and the Regulation (EU) 600/2014 as amended by Regulation (EU) 2016/1033 ("MiFIR", respectively available here and here) entered into force on 2 July 2014. MiFID II and MiFIR, together with most of the EU Commission delegated acts as well as regulatory and implementing technical standards ("RTS/ITS"), shall apply as from 3 January 2018.

According to Article 58(1)(a) of MiFID II, 'Member States shall ensure that an investment firm or a market operator operating a trading venue, which trades commodity derivatives or emission allowances or derivatives thereof, make public a weekly report with the aggregate positions held by the different categories of persons for the different commodity derivatives or emission allowances or derivatives thereof traded on their trading venue, and communicate that report to the competent authority and to ESMA'.

In accordance with Article 61(2) of MiFID II, 'the data reporting services provider shall provide all information, including a program of operations setting out, inter alia, the types of services envisaged and the organisational structure, necessary to enable the competent authority to satisfy itself that the data reporting services provider has established, at the time of initial authorisation, all the necessary arrangements to meet its obligations'.

Pursuant to Article 71(1) of MiFID II, 'Member States shall provide that competent authorities publish any decision imposing an administrative sanction or measure for infringements of MiFIR or of the national provisions adopted in the implementation of MiFID II on their official websites without undue delay after the person on whom the sanction was imposed has been informed of that decision'.

What's new?

On 21 June 2017 and 23 June 2017, the following 3 ITS pursuant to MiFID II/MiFIR were published in the Official Journal of the EU ("OJEU"):

- Commission implementing regulation (EU) 2017/1093 of 20 June 2017 laying down ITS with regard to the format of position reports by investment firms and market operators - having regard to Article 58(1)(a) of MiFID II cited above - ("ITS 4");

- Commission implementing regulation (EU) 2017/1110 of 22 June 2017 laying down ITS with regard to the standard forms, templates and procedures for the authorisation of data reporting services providers and related notifications - having regard to Article 61(2) of MiFID II cited above - ("ITS 3");

- Commission implementing regulation (EU) 2017/1111 of 22 June 2017 laying down ITS with regard to procedures and forms for submitting information on sanctions and measures - having regard to Article 71(1) of MiFID II cited above - ("ITS 8").

The ITS 4 is available here.

The ITS 3 is available here.

The ITS 8 is available here.

What's next?

The ITS 4 will enter into force on 11 July 2017.

The ITS 3 and ITS 8 will enter into force on 13 July 2017.

The ITS 4, ITS 3 and ITS 8 will apply as from 3 January 2018.

MiFID/MiFID II - Commission publishes new draft RTS

![]()

Background

The Directive 2014/65/EU ("MiFID II", available here) and the Regulation (EU) 600/2014 ("MiFIR", available here) entered into force on 2 July 2014 and will apply as from 3 January 2018.

According to Article 13(4) of MiFID II (or Article 10b(4) of MiFID, available here), 'Member States shall make publicly available a list specifying the information that is necessary to carry out the assessment and that must be provided to the competent authorities at the time of notification'.

Article 12(8) of MiFID II (or Article 10a (8) of MiFID) empowers ESMA to develop draft regulatory technical standards ("RTS") concerning an exhaustive list of information referred to in Article 13(4) of MiFID II.

On 23 March 2015, ESMA published its final report with regard to RTS for an exhaustive list of information to be included by proposed acquirers in the notification of a proposed acquisition of a qualifying holding in an investment firm (ESMA/2015/613 – the "Final Report", available here).

What's new?

On 11 July 2017, the EU Commission published its draft delegated regulation supplementing MiFID and MiFID II with regard to RTS for an exhaustive list of information to be included by proposed acquirers in the notification of a proposed acquisition of a qualifying holding in an investment firm (C(2017) 4644 final – the "Draft RTS").

Based on the Final Report, the Draft RTS sets out in details the information (e.g. information relating to the identity of the proposed acquirer, information on the persons that will effectively direct the business of the target entity, or information on the new proposed group structure and its impact on supervision) to be provided by the proposed acquirer, depending on whether the information relates to a natural person or a legal person or a trust.

The Draft RTS is available here.

What's next?

The Draft RTS is subject to the scrutiny of the EU Parliament and the Council of the EU within 3 months, before being published in the OJEU.

MMF - ESMA publishes the responses to its consultation on Money Market Funds rules

![]()

Background

The proposal for a Regulation on Money Market Funds ("MMFs") was published by the EU Commission in September 2013.

On 16 May 2017, the final text of the Regulation negotiated between the Council, the EU Parliament and the EU Commission was adopted by the General Affairs Council. The Regulation was finally published in the OJEU on 30 June 2017.

In the final consolidated text, there are a number of deliverables explicitly allocated to the ESMA, as well as empowerments for delegated acts on which the ESMA has been asked to provide technical advice to the EU Commission. These deliverables include a Technical advice and Implementing technical standards on various issues such as rules on the assessment of credit quality, or the central database, as well as Guidelines on stress-testing.

On 24 May 2017, the ESMA published a Consultation Paper on proposals of draft Technical advice, draft Implementing technical standards, and Guidelines under the MMF Regulation.

What's new?

On 8 August 2017, the ESMA published the 13 answers received to its consultation.

The key draft proposals under the different policy tools included:

- Technical advice

- The liquidity and credit quality requirements applicable to assets received as part of a reverse repurchase agreement;

- The criteria for (i) the validation of the credit quality assessment methodologies, (ii) the criteria for quantification of the credit risk and the relative risk of default of an issuer and of the instrument in which the MMF invests, as well as (iii) the criteria to establish qualitative indicators on the issuer of the instrument;

– Implementing technical standards

- The development of a reporting template containing all the information managers of MMFs are required to send to the competent authority of the MMF, including information on the characteristics, portfolio indicators, assets and liabilities of the MMF. This information will be submitted to NCAs and then transmitted to ESMA; and

- Guidelines

- The presentation of the common reference parameters of the scenarios to be included in the stress tests that managers of MMFs are required to conduct. This takes into account factors such as hypothetical changes in the level of liquidity of the assets held in the portfolio of the MMF, movements of interest rates and exchange rates or levels of redemption.

Responses to the ESMA consultation are available here.

What's next?

ESMA is expected to finalise the Technical advice and Implementing technical standards to be submitted to the EU Commission for a publication by the end of 2017.

MMF Regulation - Publication in the OJEU

![]()

Background

On 4 November 2013, the EU Commission put forward an initial draft of a money market funds ("MMF") regulation. After lengthy negotiations, the Council presidency of the EU, the EU Commission and the EU Parliament reached on 14 November 2016 a provisional agreement on the draft regulation.

On 7 December 2016, the Committee of Permanent Representatives ("Coreper") approved the final text of the MMF regulation.

On 5 April 2017, the EU Parliament voted to adopt the final text of the MMF regulation.

As a reminder, the MMF Regulation mainly foresees the following rules for MMFs:

- The regulation is applicable to all MMFs that are established, managed or marketed in the EU.

- MMFs consists of Variable NAV MMF ("VNAV"), Public Debt Constant NAV MMF ("Public Debt CNAV" or "CNAV"), and Low Volatility NAV MMF ("LVNAV", all together MMFs) presenting specific features;

- MMFs can invest in derivatives contracts (for hedging purpose), other MMFs (up to 17,5%), securitisations and ABCP (up to 15%, 20% if falling under the scope of the Simple, Transparent and Standardised securitisation and ABCP regulation, once adopted). Securities lending, borrowing as well as taking indirect exposure to commodities are not allowed;

- MMFs are subject to liquidity requirements that differ depending on the type of MMFs;

- The Board of directors of the MMF will be able to apply (i) liquidity fees on redemptions, (ii) redemption gates or (iii) suspension of redemptions gates whenever the weekly maturing assets of a CNAV MMF or an LVNAV MMF falls below 30% of the total assets of the MMF and whenever daily redemption request exceeds 10% of the total assets of the MMF. Whenever the weekly maturing assets falls below 10%, the board applies at least one of these measures.

- MMFs managers shall establish and implement a prudent internal credit quality assessment procedure, which will be reviewed annually by the management and the board;

- Stress tests will be conducted regularly (at least bi-annually);

- External support (such as cash injection, purchase of assets at inflated prices, purchase of units to maintain liquidity or providing guarantees) is prohibited;

- CNAVs and LVNAVs shall publish on a daily basis on their website and make available weekly a certain amount of information;

- Quarterly reporting to competent authorities (annually if AUM<EUR 100 millions); MMFs managers will have to implement KYC procedures and due diligence processes in order to be in a position to anticipate the effects of concurrent redemptions requests.

What's new?

On 30 June 2017, the MMF regulation was published in the OJEU (the "Regulation 2017/1131").

The Regulation 2017/1131 is available here.

What's next?

The Regulation 2017/1131 entered into force on 20 July 2017 and applied from 21 July 2018 onwards.

The review of the Regulation will take place five years after entry into force and will examine the LVNAV and CNAV regimes. It will in particular consider the feasibility of introducing an 80% EU public debt quota for Public debt CNAV MMFs. Existing funds (UCITS, AIFs) will be grandfathered for 18 months after 21 July 2018.

PRIIPs - ESAs advise on PRIIPs with environmental or social objectives

![]()

Background

The regulation (EU) 1286/2014 on key information documents ("KIDs") for packaged retail and insurance-based investment products entered into force on 29 December 2014 and will apply as from 1 January 2018 (the "PRIIPs Regulation", available here).

According to Article 8(4) of the PRIIPs Regulation, the EU Commission is empowered to adopt delegated acts specifying the details of the procedures used to establish whether a PRIIP targets specific environmental or social ("EOS") objectives.

On 10 February 2017, the ESAs published a joint consultation paper on EOS PRIIPs' draft technical advice (JC 2017 05 – the "Consultation Paper", available here). As a reminder, it covered the following aspects:

- KID and Investment Policy Statement ("IPS");

- Establishment of an IPS;

- Disclosure of the IPS to retail investors;

- Product governance rules;

- Adherence to investment objectives;

- Monitoring procedures and controls; Review of EOS PRIIPs.

What's new?

On 28 July 2017, the ESAs published their joint technical advice on the procedures used to establish EOS PRIIPs (JC 2017 43 – the "Technical Advice").

In the Technical Advice, the ESAs address mostly the following four areas:

- Where the PRIIPs’ manufacturer target EOS objectives, these objectives and how they are to be achieved should be specific. Moreover, the strategy for achieving EOS objectives should be appropriate and proportionate to these objectives.

- The PRIIPs’ manufacturer should clearly disclose the EOS objectives and how they are to be achieved to retail investors. In this respect, the ESAs highlight (i) that the KID shall set out the EOS objectives of the PRIIP in the section entitled 'What is this product?' and (ii) that further information on these specific EOS objectives and the associated investment strategy to be followed should be included in the section of the KID entitled 'Other relevant information'.

- The PRIIPs’ manufacturer should put in place governance and monitoring measures, which are proportionate to the EOS objectives and strategy and which are well-documented.

- The PRIIPs’ manufacturer should undertake regular review on the progress made in achieving the specified and disclosed EOS objectives.

At this time, the ESAs have broadly concluded that existing or future sectorial measures offer a sufficiently stringent and flexible basis for the regulation of PRIIPs targeting EOS objectives.

The Technical Advice is available here.

What's next?

On the basis of the Technical Advice, the EU Commission will adopt the delegated act required under Article 8(4) of the PRIIPs Regulation.

As from 1 January 2018, PRIIPs’ manufacturers will have to indicate in their KID, whether or not a PRIIP targets EOS objectives.

PRIIPs - ESAs publish first Q&As

![]()

Background

The KID ("Key Information Document") is a mandatory, three-page A4 information document to be provided to consumers before purchasing a Packaged Retail and Insurance-based Investment Product ("PRIIP"). The KID will need to be provided from 1 January 2018.

The rules to be applied to for the use of the KID are outlined in the Regulation PRIIPs published on 9 December 2014. The supporting technical rules are included in the Delegated Regulation (EU) 2017/653 published on 12 April 2017.

This Q&As document aims at promoting common supervisory approaches and practices in the implementation of the KID.

What's new?

On 4 July 2017, the ESAs published their Q&As document relating to the implementation of the PRIIPs’ KID (JC 2017 21 – the "Q&As").

This 35 pages’ document brings significant guidance on concrete aspects of the implementation of the PRIIPs Regulation, and notably on the methodology for the calculation of costs.

The 72 questions and answers cover the following issues:

– Market risk assessment (17 questions);

– Methodology for assessing credit risk (8 questions);

– Summary Risk Indicator (1 question);

– Performance Scenarios (2 questions);

– Derivatives (4 questions);

– Methodology for the calculation of costs:

- List of costs of investment funds (11 questions);

- Transaction costs (13 questions);

- List of costs of PRIPs other than investment funds (5 questions);

- List of costs of insurance-based investment products (3 questions);

- Calculation of the summary cost indicators (3 questions);

- Presentation of costs (3 questions);

- Other topics on costs (2 questions).

The Q&As is available here.

What's next?

The Q&As on PRIIPs is intended to be continually edited and updated as and when new questions are received.

PRIIPs - ESAs publish further guidance

![]()

Background

The Regulation (EU) No 1286/2014 entered into force on 29 December 2014 (the "PRIIPs Regulation", available here).

The PRIIPs Regulation lays down uniform rules on the format and content of the key information document for PRIIPs ("KID") to be drawn up by PRIIPs manufacturers and on the provision of the KID to retail investors in order for them to better understand and compare the key features and risks of the PRIIPs.

On 12 April 2017, the Commission Delegated Regulation (EU) 2017/653 of 8 March 2017 supplementing the PRIIPs Regulation was published in the OJEU (the "Delegated Regulation 2017/653", available here).

On 4 July 2017, the European Supervisory Authorities (the "ESAs") published their first questions & answers’ document relating to the implementation of the PRIIPs' KID (JC 2017 21 – the "Q&A v1", available here).

What's new?

On 18 August 2017, the ESAs issued further guidance on the KID requirements for PRIIPs laid down in the Delegated Regulation (EU) 2017/653 as follows:

- Additional Q&As (JC 2017 49 – the "Q&A v2");

- Diagrams explaining the risk and reward calculations required to prepare the KID, and including example calculations (the "Diagrams").

In the Q&A v2, the ESAs provided clarification on the following new questions:

- Question 1 on the categorization of a retail investor;

- Question 4 on factors not observed in the market;

- Question 11 on the use of appropriate benchmark or proxy;

- Question 29 on the calculation of the threshold for credit risk;

- Question 30 on the adjustment of the credit quality step;

- Question 31 on the use of a credit assessment assigned to a group;

- Question 33 on the calculation of the credit risk measure;

- Question 35 on the meaning of "as appropriate" in point 7 of Annex III of the Delegated Regulation 2017/653;

- Question 80 on the presentation of cost information;

- Question 81 on the biometric risk premium;

- Question 82 on the composition of costs;

- Question 83 on derivatives; and

- Question 84 on the duplication of wordings ("The person selling you or advising you about this product");

The Q&A v2 is available here.

The Diagrams are available here.

What's next?

The PRIIPs Regulation and the Delegated Regulation 2017/653 shall apply as from 1 January 2018. The ESAs will continue to assess whether further guidance is needed, in particular based on additional questions received.

PRIIPs - Guidelines published in the OJEU

![]()

Background

The Regulation (EU) No 1286/2014 entered into force on 29 December 2014 and will apply as from 1 January 2018 (the "PRIIPs Regulation", available here).

The Commission Delegated Regulation (EU) 2017/653 laying down regulatory technical standards ("RTS") with regard to the presentation, content, review and revision of key information documents ("KIDs") and the conditions for fulfilling the requirement to provide such documents was published in the OJEU on 12 April 2017 (the "DR 2017/653", available here).

On 4 July 2017, the European Supervisory Authorities (the "ESAs") published their first questions and answers documents on PRIIPs KID (JC 2017/21 – the "Q&A", available here).

On the same date, the EU Commission published its draft guidelines on PRIIPs (the "Draft Guidelines", available here).

It is to be noted that the Draft Guidelines do not contain or create new legal rules. The Draft Guidelines seek to further facilitate the implementation of the PRIIPs Regulation by smoothing out potential interpretive divergences throughout the EU around the following topics:

- Territorial application of PRIIPs;

- Use of KIDs by UCITS;

- Translation of KIDs;

- Distribution of a PRIIP; 'On demand' or 'real time' KIDs.

What's new?

On 7 July 2017, the Draft Guidelines were published in the OJEU (the "Guidelines").

The Guidelines are available here.

What's next?

The PRIIPs Regulation does not provide for any specific transitional legal regime concerning PRIIPs made available to retail investors before 1 January 2018 that continue to be made available to retail investors after 1 January 2018 and it therefore applies to those PRIIPs.

Where a PRIIP is no longer made available to retail investors as of 1 January 2018 and changes to the existing commitments are only subject to the contractual terms and conditions agreed before that date, a KID is not required. Where those contractual terms and conditions allow exiting the PRIIP, but that PRIIP is no longer made available to other retail investors after 1 January 2018, a KID is not required.

PRIIPs - Second Corrigendum to RTS published in the OJEU

![]()

Background

The Regulation (EU) No 1286/2014 entered into force on 29 December 2014 (the "PRIIPs Regulation", available here).

The PRIIPs Regulation lays down uniform rules on the format and content of the key information document for PRIIPs ("KID") to be drawn up by PRIIPs manufacturers and on the provision of the KID to retail investors in order for them to better understand and compare the key features and risks of the PRIIPs.

On 12 April 2017, the Commission Delegated Regulation (EU) 2017/653 of 8 March 2017 supplementing the PRIIPs Regulation was published in the OJEU (the "Delegated Regulation 2017/653", available here).

The Delegated Regulation 2017/653 covers most notably the following items:

- The disclosure of comprehension alert in KIDs;

- The risk categorisation of insurance products;

- The specific nature of Multi-Option Products ("MOPs");

- The inclusion of 4 performance scenarios in KIDs.

On 11 May 2017, a first corrigendum to the annexes II and IV of the Delegated Regulation 2017/653 was published in the OJEU (the "Corrigendum 1", available here).

What's new?

On 15 August 2017, a second corrigendum to the annex VII of the Delegated Regulation 2017/653 was published in the OJEU (the "Corrigendum 2").

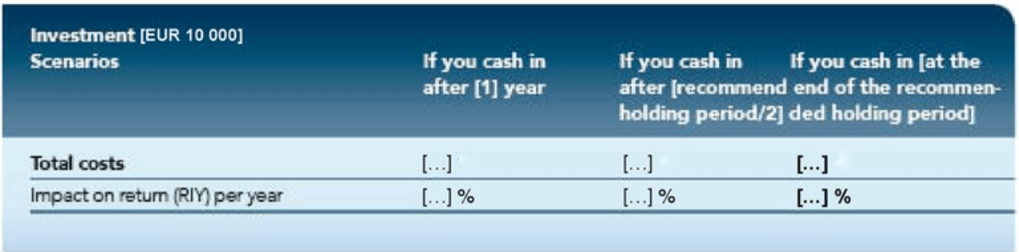

With reference to the Corrigendum 2, the table 1 of the Annex VII of the Delegated Regulation 2017/653 shall be read as follows:

The Corrigendum 2 is available here.

What's next?

The PRIIPs Regulation and the Delegated Regulation 2017/653 shall apply as from 1 January 2018.

Prospectus Regulation - Publication in the OJEU

![]()

Background

On 30 September 2015, the EU Commission published an action plan on a capital markets union (the "CMU", available here), aiming at achieving a true single market for capital across the 28 EU Member States. Part of this plan is the revision of the rules applying under the prospectus directive in order to make it less costly for businesses to raise funds publicly, and to simplify the requirements, which were sometimes burdensome in particular for small and medium companies ("SME").

On 30 November 2015, the EU Commission published a proposal for a regulation on Prospectus (COM(2015) 583 final – the "Commission Proposal", available here), which aims to (i) reduce fragmentation in financial markets in order to make it easier for EU businesses to obtain funding, and to (ii) improve protection of investors by giving them shorter, yet detailed and comprehensible information on investment products to help them decide whether or not to invest.

On 16 December 2016, the EU Parliament and the Council of the EU struck a compromise on the Prospectus regulation in trilogue (the "Compromise", available here).

On 5 April 2017, building on the Compromise, the EU Parliament Plenary adopted the final text of the Prospectus regulation (the "Final Text", available here). As a reminder, the main changes to the current prospectus regime are the following:

- Modification of the thresholds regarding the obligation to draft a prospectus, the level of which has been raised from EUR 100 000 to EUR 1 000 000. (Article 1);

- Simplified disclosure regime for frequent issuers – (Article 14);

- A new growth prospectus has been created for a certain category of issuers (Article 15);

- The prospectus content has been amended as below indicated;

- The materiality of the risk factors shall be assessed based on the probability of their occurrence and the expected magnitude of their negative impact (Article 16);

- The issuer will be able to not disclose certain information in the prospectus under certain circumstances (Article 18);

- The prospectus will be available to the public in an electronic form (Article 14);

- The prospectus summary has been harmonised with the requirements that apply under the PRIIPs Regulation (Article 7);

- The base prospectus shall be drawn for any kind of non-equity securities (Article 8);

- Establishment of a "tripartite prospectus"; and

- SMEs are exempted from prospectus publication with regard to employee-shares scheme.

What's new?

On 30 June 2017, the Regulation (EU) 2017/1129 was published in the OJEU with no significant departure from the Final Text (the "New Prospectus Regulation").

The New Prospectus Regulation is available here.

What's next?

The New Prospectus Regulation entered in force on 20 July 2017 and shall apply from 21 July 2019 onwards. Shares resulting from the conversion or exchange of other securities or from the exercise of the rights conferred by other securities pursuant to article 1(5) (b) shall be exempted from the obligation to publish a prospectus starting from 20 July 2017.

UCITS - ESMA Q&As update

![]()

Background

The Undertakings for Collective Investment in Transferable Securities ("UCITS") Directive puts in place a comprehensive framework for the regulation of harmonised investment funds within Europe.

The ESMA is required to play an active role in building a common supervisory culture by promoting common supervisory approaches and practices. It does this by providing responses to questions posed by the general public and competent authorities in relation to the practical application of the UCITS Directive.

What's new?

On 11 July 2017, the ESMA published an updated questions and answers document on the application of the UCITS Directive, including two new questions and answers (ESMA34-43-392 – the "Updated Q&As on the UCITS Directive").

- The 40% limit (total of issuers representing more than 5 % of net assets of the UCITS) does not apply to index-tracking UCITS that comply with the requirements set out in Article 53 (i.e. representability, diversification, appropriate publication).

- A person who served in the management body of an entity should be deemed to fulfil the independence requirement only after an appropriate cooling-off period following, starting from the final payment of any outstanding remuneration due to him/her. The cooling-off period should be proportionate to the length of the employment or other relationship that the individual had with any of the companies within the group and to the type of functions performed.

The Updated Q&As on the UCITS Directive is available here.

What's next?

The Q&As on the UCITS Directive is intended to be continually edited and updated as and when new questions are received.

LUXEMBOURG

AIFMD - CSSF updates its FAQ to specify the impact of the PRIIPs Regulation on AIFs

![]()

Background

The CSSF frequently asked questions ("FAQ") document on the alternative investment fund managers’ directive ("AIFMD", available here) and its implementing measures (e.g. the Law of 12 July 2013, available here) provides guidance on some of the key aspects of the AIFMD from a Luxembourg point of view.

The CSSF last updated its FAQ on AIFMD on 9 June 2016 (the "FAQ v10", available here). The CSSF FAQ on AIFMD shall be read in conjunction with the corresponding ESMA questions and answers document (the "ESMA Q&A", available here).

The Regulation (EU) No 1286/2014 entered into force on 29 December 2014 and will apply as from 1 January 2018 (the "PRIIPs Regulation", available here).

What's new?

On 6 July 2017, the CSSF updated its FAQ v10 by inserting a new section 23 in order to specify the impact of the PRIIPs Regulation on Luxembourg AIFs (the "FAQ v11").

In the FAQ v11, the CSSF highlights most notably the following:

- Manufacturers of Luxembourg AIFs the units of which are being advised on, offered or sold to retail investors need to have in place a PRIIPs KID as of 1 January 2018, unless they benefit from the exemption provided under Article 32(2) of the PRIIPs Regulation;

- Such AIFs may issue a UCITS KIID before 1 January 2018 in order to be exempted from the obligations of the PRIIPs Regulation until 31 December 2019, provided that the following conditions are complied with:

- The UCITS KIID to be issued under the Law of 17 December 2010 should comply with Articles 159 to 162 of this Law (available here), as well as with the provisions of the EU Commission Regulation No 583/2010 (available here);

- The UCITS KIID should be issued for each retail share class of the sub-funds of the relevant Luxembourg AIF before 1 January 2018;

- The offering document of the Luxembourg AIF in question should be amended in order to reflect the distribution of a UCITS KIID to all retail investors contemplating an investment in the AIF. The offering document should also mention that the UCITS KIID shall be published on the website of the registered or authorised AIFM of the Luxembourg AIF and that it shall be available, upon request, in paper form.

- Luxembourg AIFs that have issued a UCITS KIID need to file a final version of such document with the CSSF;

- By 1 January 2020, all AIFs that are advised on, offered or sold to retail investors and that were exempted under Article 32(2) of the PRIIPs Regulation need to have in place a PRIIPs KID, unless such deadline would be postponed by the EU Commission;

- The CSSF requires the notification of a final PRIIPs KID (including any updates) by the (manufacturer of) a Luxembourg AIF the units of which are advised on, offered or sold to retail investors;

- The CSSF strongly recommends, that Luxembourg AIFs that are exclusively advised on, offered or sold to professional investors amend their offering documents before 1 January 2018 in order to include a reference to the fact that their units are solely advised on, offered or sold to professional investors and that, as a consequence, no PRIIPs KID shall be issued. As an alternative to the amendment of the offering document, the CSSF can be provided with a duly completed and signed self-assessment form which assesses the status of the AIF as being an AIF the shares or units of which can exclusively be subscribed or acquired by professional investors (available here).

The FAQ v11 is available here.

What's next?

The FAQ v11 is intended to be continually edited and updated as and when new questions are received.

MiFID II - CSSF endorses ESMA guidelines on knowledge and competence in Circular 17/665

![]()

Background

The Directive 2014/65/EU ("MiFID II", available here) entered into force on 2 July 2014. MiFID II will be applicable as from 3 January 2018.

According to Article 25 (1) of MiFID II, Member States ("MS") shall require investment firms to ensure and demonstrate to competent authorities ("CAs") on request that natural persons giving investment advice or information about financial instruments, investment services or ancillary services to clients on behalf of the investment firm possess the necessary knowledge and competence to fulfill their obligation under Article 24 and this article.

Following Article 25(9) of MiFID II, the ESMA shall adopt guidelines by 3 January 2016, specifying criteria for the assessment of knowledge and competence required under paragraph (1).

On 3 January 2017, the ESMA released the Guidelines to specify the criteria for the assessment of knowledge and competence required under Article 25(1) of MiFID II ((ESMA71-1154262120-153 EN – the "Guidelines" available here). In accordance with Article 16(3) of regulation 1095/2010 (the "ESMA Regulation" available here), CAs and financial market participants must make every effort to comply with the Guidelines. The Guidelines were published on ESMA website on 22 March 2017 and apply to firms described below:

- Investment firms as defined in Article 4 (1)(1) of MiFID II;

- Credit institutions when selling or advising clients in relation to structured deposit;

- UCITS management companies and external AIFMs insofar as they are providing the investment services of individual portfolio management or non-core services and only in connection with these services (respectively within the meaning of Article 6(3)(a) and (b) of the UCITS Directive and 6(4)(a) and (b) of the AIFMD.

The Guidelines apply as from 3 January 2018.

In Luxembourg, the Law of 5 April 1993 on the financial sector, as amended set forth the rules for access to professional activities in the financial sector (the "Law").

What's new?

On 3 August 2017, the CSSF published its circular 17/665 implementing the Guidelines in Luxembourg’s financial sector (the "Circular").

The Circular is addressed to all professionals operating under the CSSF supervision who (i) provide investment services and perform activities described under Annexe II, section A of the Law, and (ii) market or provide investment advice on structured deposits or (iii) provide ancillary services as set forth under annexe II, section C of the Law set forth the following:

- The criteria for knowledge and competence for staff giving information about investment products, investment services or ancillary services.

- Criteria for knowledge and competence for staff giving investment advice;

- Organisational requirements for assessment, maintenance and updating knowledge and competence;

- The publication requirements imposed on CAs with regard to information to be published on its website.

The Circular is available here (only in French).

What's next?

The Circular entered into force on 3 August 2017 and will apply as from 3 January 2018.

SIFs/SICARs - CSSF publishes its first FAQ on the impact of the PRIIPs Regulation

![]()

Background

The Luxembourg regimes for specialised investment funds ("SIFs") and investment companies in risk capital ("SICARs") were amended by the Law of 12 July 2013 on alternative investment funds ("AIFs), which implements the Directive 2011/61/EU (the "AIFMD", available here).

The Regulation (EU) No 1286/2014 entered into force on 29 December 2014 and will apply as from 1 January 2018 (the "PRIIPs Regulation", available here).

On 6 July 2017, the CSSF published its eleventh version of its frequently asked questions ("FAQ") document on the AIFMD and its implementing measures to detail the impact of the PRIIPs Regulation on Luxembourg AIFs (the "FAQ on AIFMD", available here). The FAQ on AIFMD shall be read in conjunction with the corresponding ESMA questions and answers document (the "ESMA Q&A", available here).

What's new?

On 6 July 2017, the CSSF published its first FAQ on SIFs/SICARs that do not qualify as AIFs to specify the impact of the PRIIPs Regulation on them (the "FAQ on SIFs/SICARs").

In the FAQ on SIFs/SICARs, the CSSF highlights most notably the following:

- Manufacturers of Luxembourg SIFs and SICARs that do not qualify as AIFs the units of which are being advised on, offered or sold to retail investors need to produce a PRIIPs KID as of 1 January 2018;

- If they choose to issue a UCITS KIID-like document (as per Article 161(1) of the Law of 17 December 2010, available here) before 1 January 2018, they are exempted from the obligations of the PRIIPs Regulation until 31 December 2019 under Article 32(2) of the PRIIPs Regulation, unless such deadline would be postponed by the EU Commission;

- It is confirmed that the questions and answers 23.b) to 23.q) to the FAQ on AIFMD apply to the drawing up of a PRIIPs KID by Luxembourg SIFs and SICARs that do not qualify as AIFs.

The FAQ on SIFs/SICARs is available here.

What's next?

The FAQ on SIFs/SICARs is intended to be continually edited and updated as and when new questions are received.

UCIs – CSSF FAQ updates on independence requirement and impact of PRIIPs

![]()

Background

The Luxembourg Law of 17 December 2010 relating to undertakings for collective investment (the "UCIs Law", available here) was amended by the Law of 12 July 2013 on alternative investment funds, which implements the Directive 2011/61/EU (the "AIFMD", available here).

The Regulation (EU) No 1286/2014 entered into force on 29 December 2014 and will apply as from 1 January 2018 (the "PRIIPs Regulation", available here).

The EU Commission delegated regulation 2016/438 supplementing the Directive 2009/65/EC (the "UCITS V", available here) regarding the obligations of depositaries applies since 13 October 2016 (the "UCITS V Delegated Regulation", available here).

On 24 January 2017, the CSSF published the third version of its frequently asked questions document on the UCIs Law (the "FAQ v3", available here).

On 30 January 2017, the ESMA published its opinion on UCITS share classes (ESMA34-43-296 - the "ESMA Opinion", available here).

On 6 July 2017, the CSSF published its eleventh version of its FAQ on the AIFMD and its implementing measures to detail the impact of the PRIIPs Regulation on Luxembourg AIFs (the "FAQ on AIFMD", available here). The FAQ on AIFMD shall be read in conjunction with the corresponding ESMA questions and answers document (the "ESMA Q&A", available here).

What's new?

On 6 July 2017, the CSSF published the fourth version of its FAQ on the UCIs Law (the "FAQ v4").

In the FAQ v4, the CSSF provides clarification on the three following areas:

- The independence requirements set forth by Chapter 4 of the UCITS V Delegated Regulation, with a schematic overview of the impact of Articles 21 and 24 of the UCITS V Delegated Regulation on Luxembourg entities;

- The impact of the PRIIPs Regulation on manufacturers of Luxembourg UCITS

- As of 1 January 2020, unless such deadline would be postponed by the EU Commission, manufacturers of Luxembourg UCITS need to have in place a PRIIPs KID;

- The FAQ v4 refers to point 23 of the FAQ on AIFMD for more details on the drawing up of a PRIIPs KID.

- The impact of the ESMA Opinion on existing share classes, with details on the transitional provisions (until 30 July 2018) and the high-level principles (i.e. common investment objective, non-contagion, pre-determination and transparency).

The FAQ v4 is available here.

What's next?

The FAQ on the UCIs Law is intended to be continually edited and updated as and when new questions are received.

FRANCE

Mutual Recognition of Funds (MRF) between France and Hong Kong

![]()

Background

On 10 July 2017, the Autorité des Marchés Financiers (AMF) and the Securities and Futures Commission (SFC) signed a Memorandum of Understanding (MoU) on France-Hong Kong mutual recognition of funds. This MoU enters into force upon signature of the Authorities.

What's new?

The MoU provides a framework for mutual recognition of covered funds offered, marketed and distributed to retail investors in France and the public in Hong Kong.

The French (or Hong Kong) Covered Fund must be a general equity fund, bond fund or mixed fund as defined in Annex C to the SFC (and AMF) Circular. It must not be a money market fund, an exchange traded fund, an index fund, or a structured fund.

The French Covered Fund must be an undertaking for collective investment in transferable securities (UCITS) authorized in accordance with Article 5 Directive 2009/65/EC.

At least 20% of the French Covered Fund’s net asset value must be attributable to investors in France. In the same way, the Hong Kong Covered Fund shall have at least 20% of its net asset value attributable to investors in Hong Kong.

Each French (or Hong Kong) Covered Fund must appoint a firm in Hong Kong (or France) as its representative.

Other principles and requirements are described in the AMF and SFC Circulars.

What's next?

The SFC and the AMF may consider extending the MRF to include other types of funds in future in accordance with the MoU.

This publication is produced by Legal and Compliance teams of CACEIS with the kind support of Communication teams and Group Business Development Support teams.

Editors

Gaëlle Kerboeuf, Group General Counsel

Permanent Editorial Committee

Gaëlle Kerboeuf, CACEIS Group Legal

Elisabeth Raisson, CACEIS Group Compliance

Corinne Brand, CACEIS Marketing and Communication Specialist (France)

Alice Broussard, CACEIS Compliance and Regulatory Watch

Special Contribution

Jacqueline Quintric, Legal (Luxembourg)

Clemence Dubreuil, Legal (France)

Mireille Mol, Legal and Compliance (Netherlands)

Support

Ana Vazquez, Group Head of Legal

Eliane Meziani-Landez, Legal (France)

Tania Delchev, Legal (France)

Corentin Stefan (France)

Fernand Costinha, Legal (Luxembourg)

Stefan Ullrich, Legal (Germany)

Costanza Bucci, Legal and Compliance (Italy)

Mireille Mol, Legal and Compliance (Netherlands)

Charles du Maisnil, Legal - Risk & Compliance (Belgium)

François Honay, Legal (Belgium)

Arianne Courtois (Belgium)

Helen Martin, Legal (Ireland)

Samuel Zemp, Legal and Compliance (Switzerland)

Malgorzata Journo, Legal (France)

Robin Donagh, Legal (Ireland)

Sylvie Becker, Legal (Luxembourg)

Design

Sylvie Revest-Debeuré, CACEIS, Communications

Photos credit

Yves Maisonneuve, Yves Collinet, CACEIS, Fotolia

CACEIS

1-3, place Valhubert

75206 Paris CEDEX 13

www.caceis.com

This publication is provided by CACEIS from sources believed to be reliable. The present publication is not intended as an offer to sell or a commercial solicitation and may be amended at any time by CACEIS. Information contained in the present newsletter are not a substitute to legal, taxation or investment consultation or advice from an appropriately qualified professional. CACEIS does not warrant the accuracy and completeness of this newsletter, nor endorse or make any interpretation about its content. In no event will CACEIS be liable for any damages whatsoever arising out of the use of, or reliance on the content of this newsletter. Unauthorized used or distribution without the prior written permission of CACEIS is prohibited.